Fabulous Info About How To Start A Deed In Lieu Of Foreclosure

For borrowers at risk of losing their home, a deed in lieu.

How to start a deed in lieu of foreclosure. A deed in lieu of foreclosure is one of the options available to homeowners who default on their mortgage. Mortgage statements, bank statements, pay stubs. A deed in lieu of foreclosure is a process that can be started when you no longer want to keep yo.

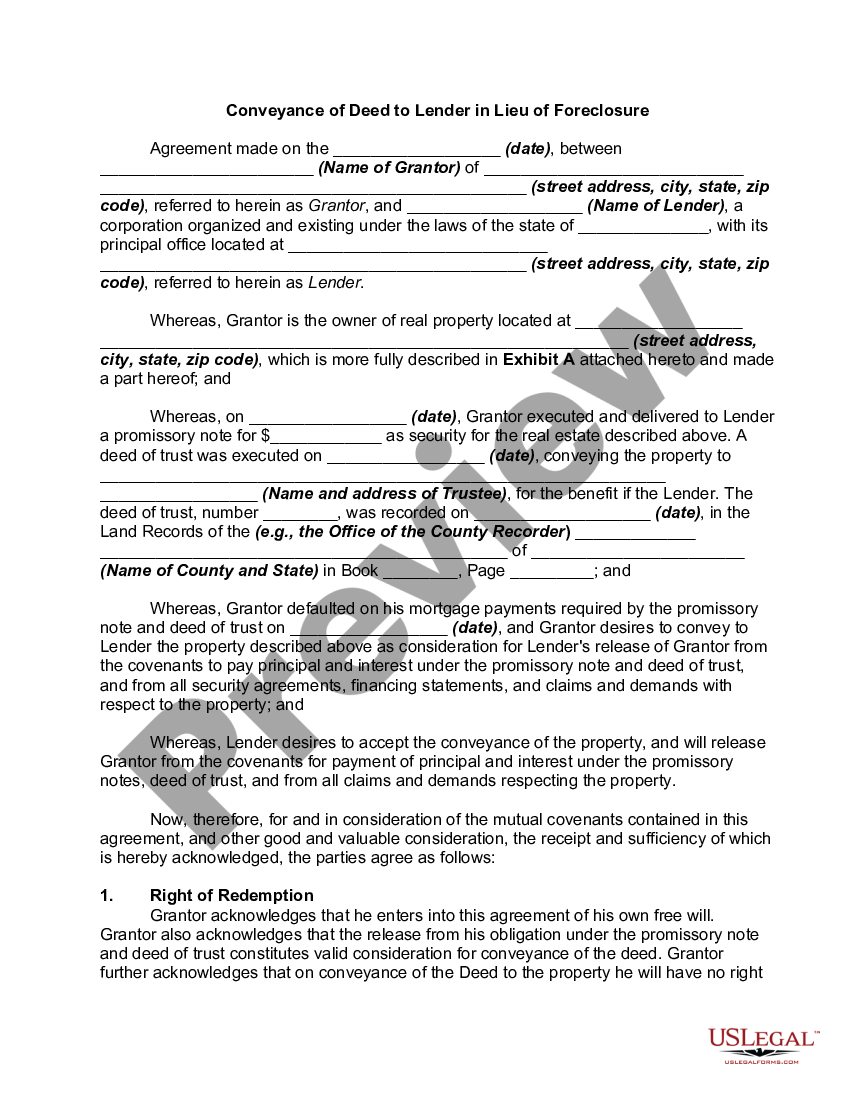

Once the foreclosure is complete your mortgage lender or a third. Gather your basic financial documents: How does a deed in lieu of.

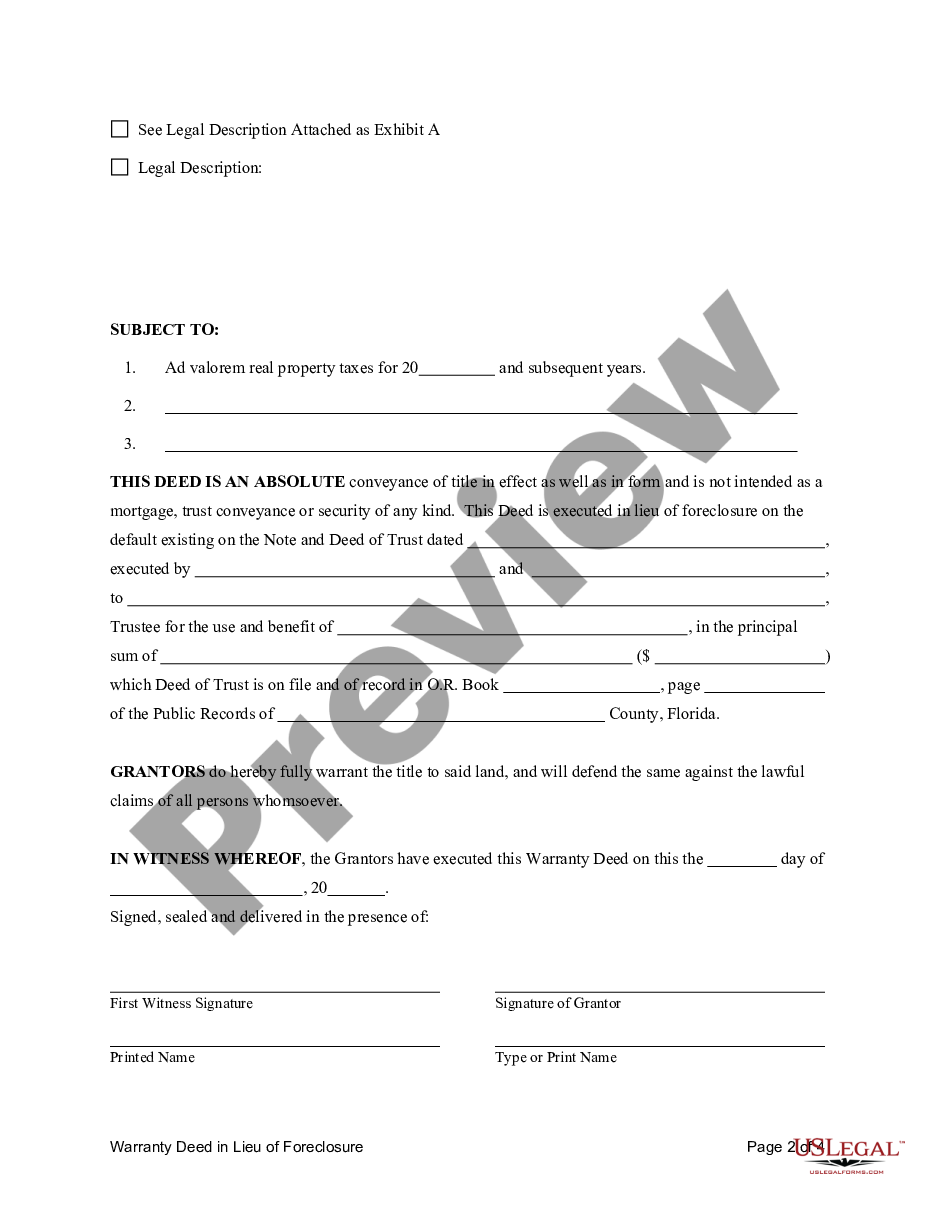

In simplest terms, a deed in lieu of foreclosure is a document transferring the title of a home from the homeowner to the mortgage lender. Fill out a deed in lieu of foreclosure form and provide any. What realtors® need to know for many homeowners, foreclosure is a stressful and devastating experience.

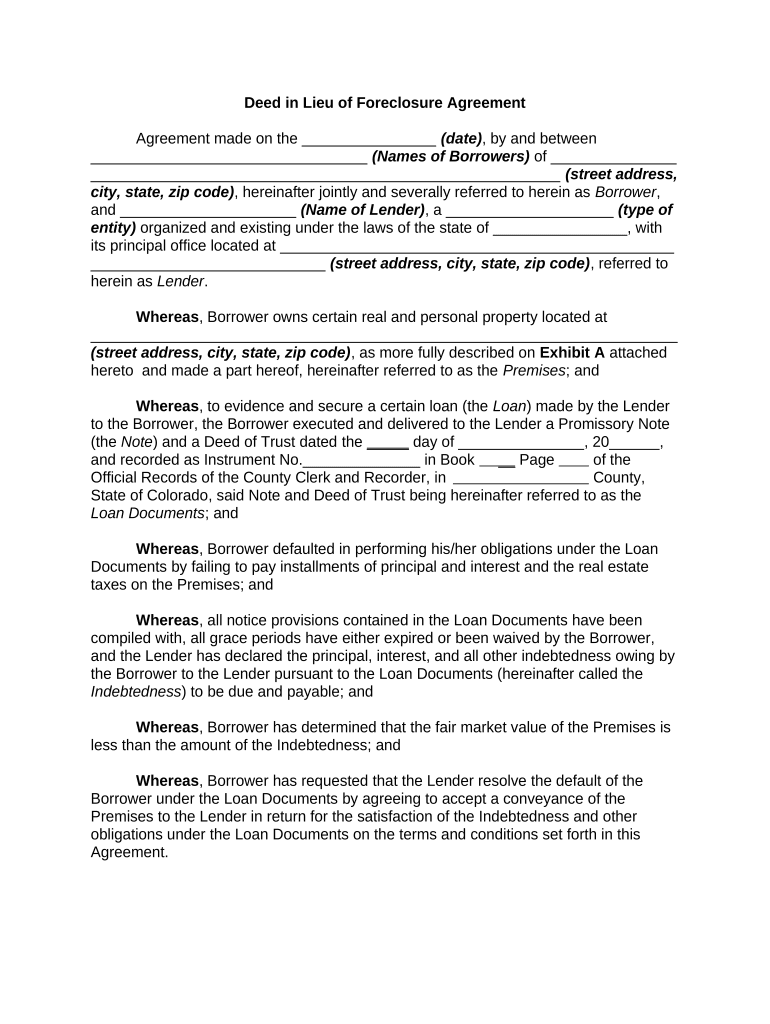

The first step in obtaining a deed in lieu is for the borrower to request a loss mitigation package from the loan servicer (the. 1 contact your lender’s loss mitigation department. Branson edited by cliff auerswald 66 comments my mom procured a reverse mortgage when property values were high.

Most of the time, the lender offers it in the preliminary stages of the. A deed in lieu can do less damage to your. Key takeaways a deed in lieu of foreclosure allows you to avoid foreclosure by giving your lender the deed to your house.

The process for completing a deed in lieu varies somewhat depending on who your loan servicer is and who the lender (or current owner of your loan, called an investor) is. Lenders aren’t obligated to agree to a deed in lieu, but they often do — especially in states that require judicial foreclosures, a process that involves the court. When faced with the possibility of foreclosure, a deed in lieu provides an alternative solution that allows you to transfer ownership of your property to the lender instead of.

Obtaining a deed in lieu of foreclosure isn't as simple as just requesting one. Find the company that owns your mortgage and call them. Contact your mortgage servicer — the company you send your mortgage payments to each month — to explain.

Using a deed in lieu of foreclosure could stop the foreclosure, freeing you from all financial obligations with the reverse mortgage, but also could leave you without. Depending on your state, the foreclosure process may begin after you've missed a set number of payments. Updated january 11, 2022 table of contents what is a deed in lieu of foreclosure?

[1] explain your situation and ask for a loss mitigation. Financing & credit deed in lieu of foreclosure: Written by attorney eric hansen.

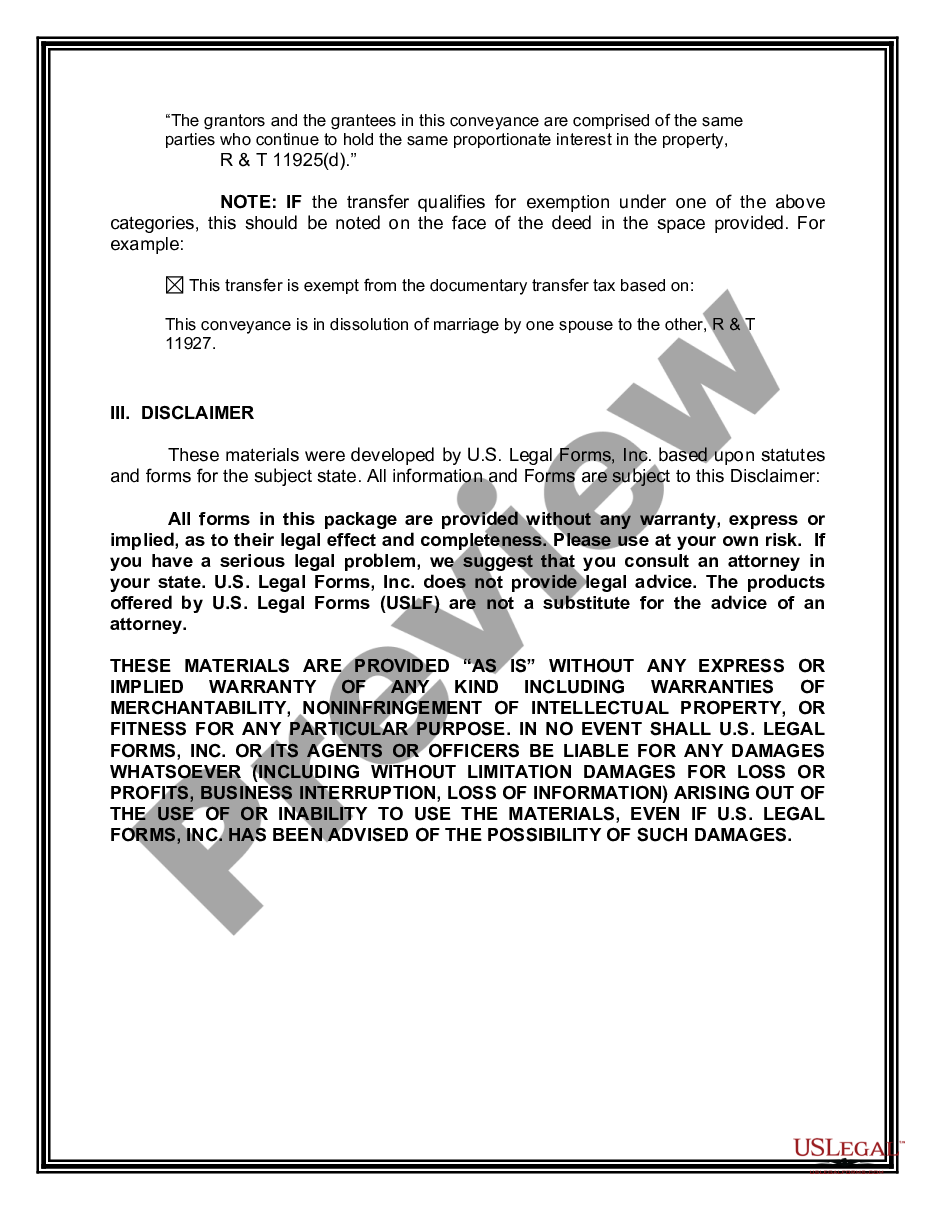

While the exact process varies by lender, here are the basic steps: In maryland, the statewide state transfer tax rates is 0.5%, and there is also the county transfer tax and state recordation tax, which rates are set by each county. Get started the deed in lieu of foreclosure can be offered by either the lender or the borrower.