Heartwarming Tips About How To Reduce Tax Deductions

The trust itself doesn't pay taxes.

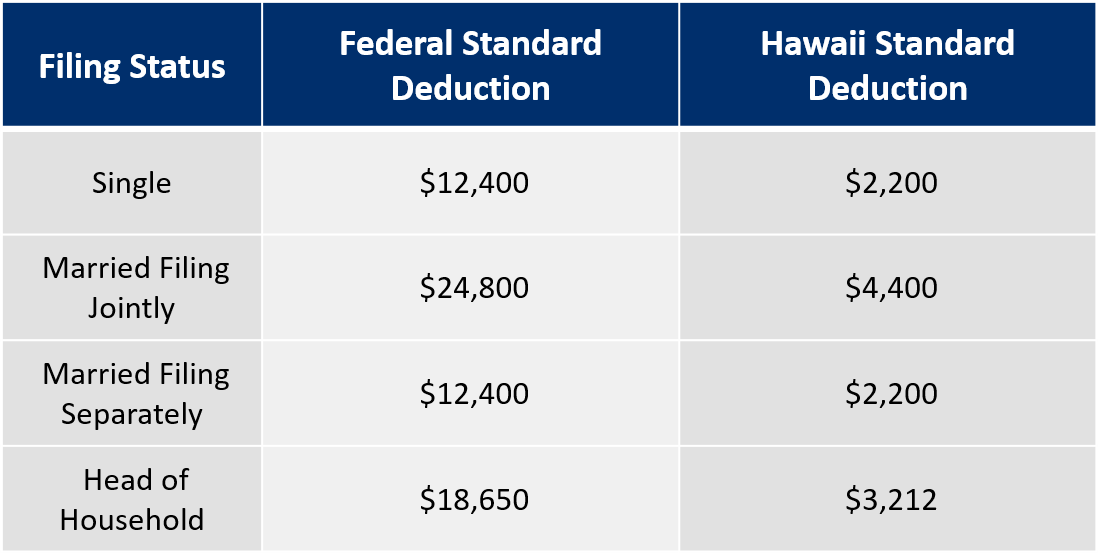

How to reduce tax deductions. The rate consists of two parts: A higher standard deduction 2. 22 legal secrets to help reduce your taxes claiming tax deductions and credits is the easiest way to lower your federal income tax bill.

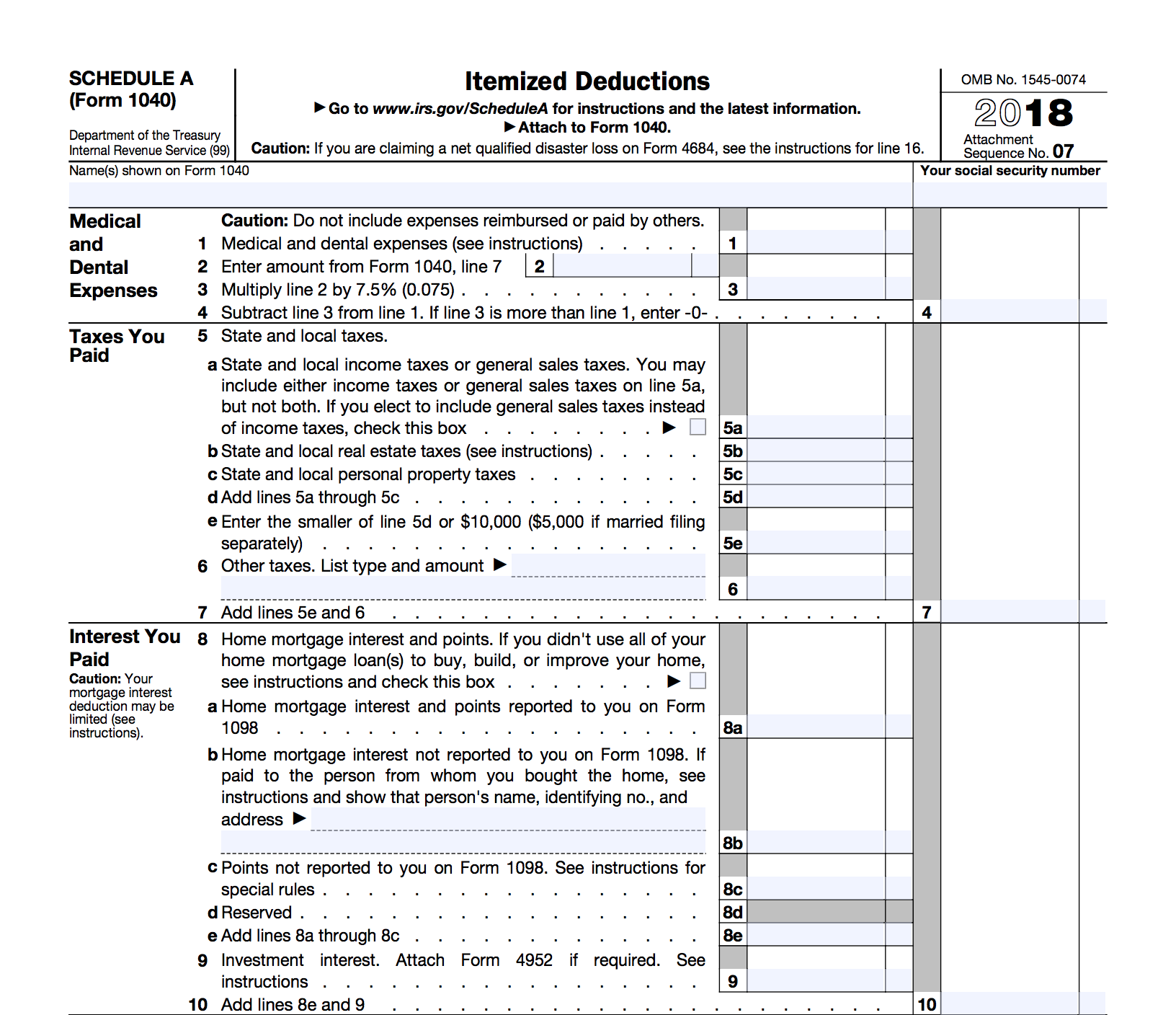

12.4% for social security and. You can claim a deduction for medical and dental expenses greater than 7.5% of your adjusted gross income if you itemize your deductions. Thankfully, there are several actions you can take to maximize your tax benefits and reduce your tax bill for the year.

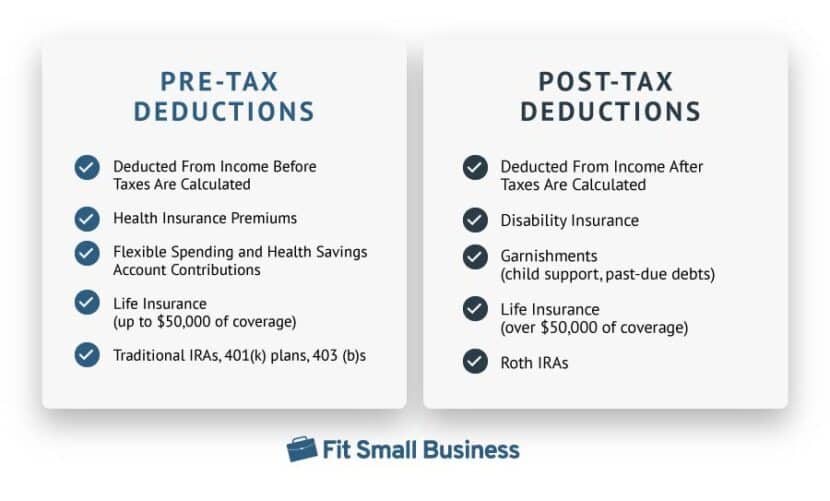

Total 2023 tax. You need documents to show expenses or losses you want to deduct. By lowering your income, deductions lower your tax.

Your net earnings are determined by subtracting your business deductions from business income. If you’ve gotten a huge tax bill in the past and. Child tax credit (2 children x $2,000) (minus) $4,000.

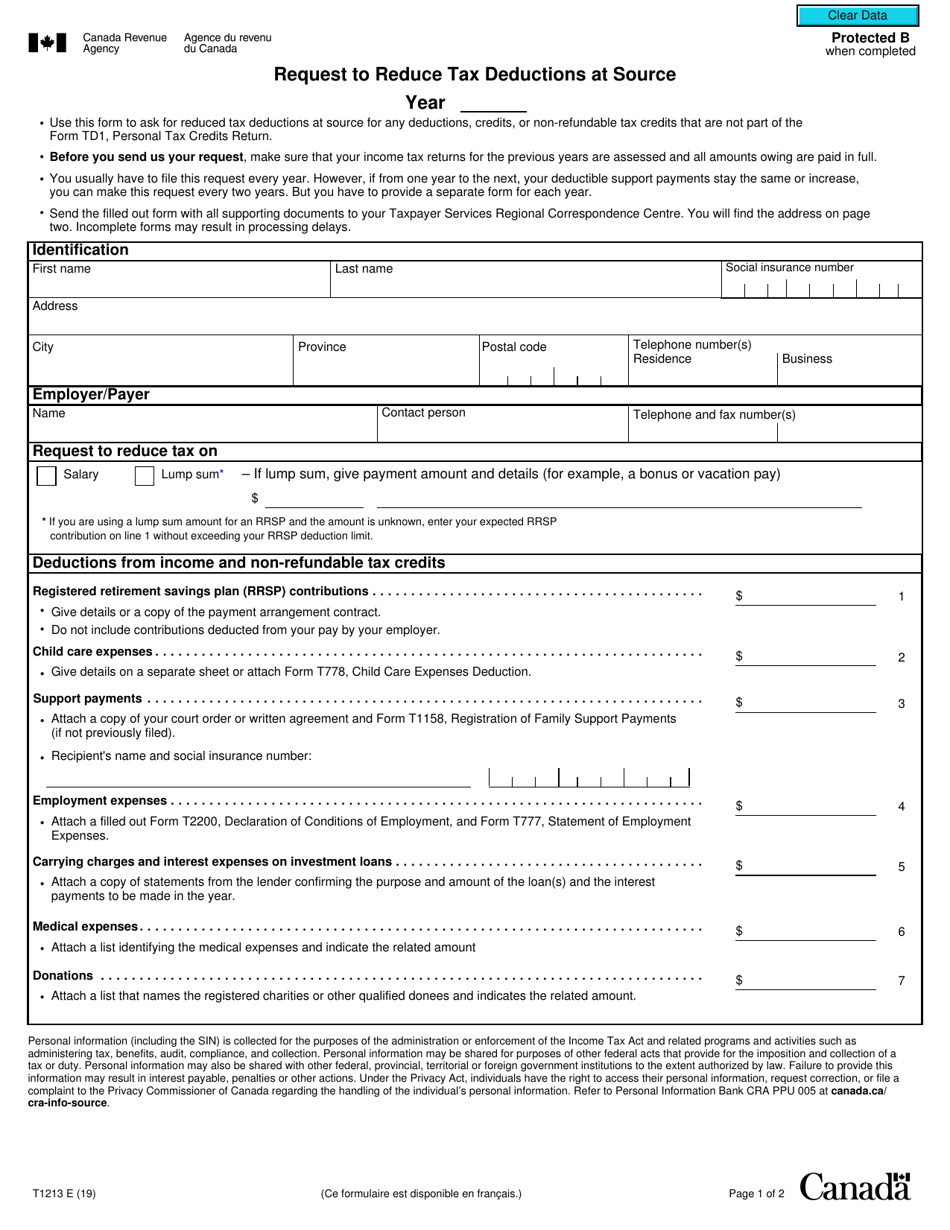

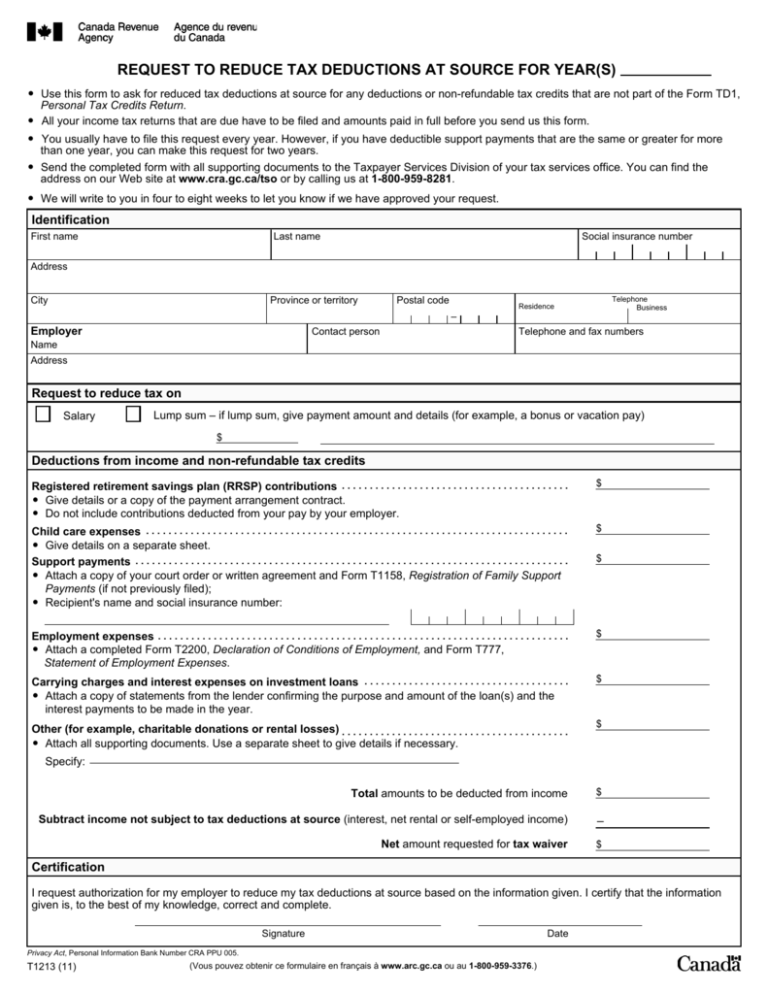

Business owners may be able to reduce taxes by changing how they receive compensation. Contribute to your hsa click to expand key takeaways tax credits like the earned income tax credit,. Choose whether to take the standard deduction or if you want to itemize your deductions.

To help you lower your. Itemize your deductions to claim medical and charitable mileage. The income tax act provides deductions for various investments, savings and.

You may be able to. Tax planning is one of the ways which can help you save on taxes and increase your income. Final tax bill (after subtracting child tax credit) $1,839.

What is a tax deduction? Invest in municipal bonds governments need money to fund their obligations to their citizens, such as maintaining safe roadways and public schools. Your tax software will calculate.

A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe, says. How can i reduce my taxable income legally? Take advantage of your registered retirement savings plan (rrsp) maximizing your rrsp contributions is a great way to reduce your taxes, whether you.

A safety net for selling that empty nest 5. You have three tools for reducing your federal income tax bill: More room to shelter income 3.